What market research is valuable to your business

It doesn’t matter whether you are a large or small business, marketing research is what makes the difference between a product or service that is in demand and generates high order values, and one with low demand from one-and-done clients (buy from you once and never do so again). But it can be difficult to know how to do market research for a small business.

Market research can tell you:

- What your competitors are doing, and even possibly what is working for them and where the gaps are

- Trends in the marketplace – what is predicted to happen and what other businesses are doing about it

- The needs, priorities and purchase criteria of your products/services among your audience

- Where your audience are and how best to reach them.

It is valuable insight for ensuring your marketing spend delivers a greater return on investment. You can feel confident that the money spent is marketing you to the right audience, with the right message to get their interest, and for that to happen at the right time.

Market research for a small business shouldn’t be complicated

It can be somewhat daunting to embark on market research, and it is all too easy to make this overly complex. For there to be robust and actionable insights from your research you don’t need to achieve statistical significance or have thousands of respondents to a survey. You simply need enough data and research to be able to see trends, patterns and themes.

An additional benefit you have as a small business, is that you tend to work with and know the customers personally (maybe not all of them, but certainly many). As a result, you can more easily and instinctively interpret what they are like, what they care about, what motivates them and what they need.

This is less true of larger businesses where they deal with thousands or hundreds of thousands of customers/clients. In that setting there is a genuine need for large statistical models in order to capture sufficent data to understand it in a more granular way.

One of the times you might want to make your own market research mor complex is when you need greater levels of data to support a new product development process; but more on that later.

How to do market research for a small business...

1. Competitor research

Understanding what your competitors are up to, what’s working for them and what they aren’t doing can give you vital information about where the gaps are in your own marketing and what can differentiate you from them.

This type of research will only allow you to match and even slightly exceed the competition, but it’s a great place to start to ensure you’ve the basics in place and understand who else is influencing your prospective audience.

Research here could comprise:

- Website reviews – analysing the experience of competitors website, content, how they position and market themselves etc

- Social media audits – looking at how active they are and the type of content they promote, as well as what generates engagement and action.

- Website auditing technology – you’ll likely only have this if you work with a marketing agency as the costs to license are high, but with these more advanced tools you can get under the bonnet of a competitors website. Examples of insights resulting can include domain authority, number and quality of backlinks, website load speed, keyword targeting etc. These are the background mechanics that can tell you how successful their website is, and how they target prospective clients with digital marketing, so that you can then make a more true comparison to your own efforts.

2. Sector and industry-specific market research

Market research for your small business should go beyond marketing average and look for marketing excellence. Sector and industry market research can give you more precise and relevant insights and data about forward trends, issues and customer priorities.

Trade bodies, official associations and the trade press are often valuable sources of information too. Many of these provide annual or quarterly state of the sector reports which can provide you with hard metrics, alongside commentary and opinion pieces from experts reflecting on the sector.

The insights from this can help shape your marketing messages, new product development, business operations and more.

3. Customer and client research

As marketer Andy Bounds would say, “without a target audience, it’s like throwing jelly against a wall and hoping it sticks”.

A great place to start in defining your target audiences is to review your own clients, and prospects, both current and past.

By mapping out their characteristics such as age, gender, interests, ways they prefer to do business, business size (in the case of B2B) and so on, you can start to create audience personas.

It may be the case that you’ve four different audiences, all actually buying the same services/product from you but they are looking for a different experience with it, or prioritising different criteria when making their purchase decisions.

As an example, let’s discuss a cleaning business. The criteria and priorities of a commercial client versus a domestic one will be quite different, not to mention the difference in service requirement to clean an industrial location versus an office space.

Another option is to interview your clients to find out more about them. There are relatively few clients who don’t like the idea of having their opinions listened to by a business they are working with!

To enlist as honest a response as possible, you may find it best to have someone other than their main point of contact do this. Have some pre-set questions and it need only take five minutes. Just make sure not to cherry-pick clients, and ensure you get a true range of opinions.

This doesn’t have to be for current clients only. Prospects and past clients can also be interviewed, and are likely to generate more interesting insights but there does need to be a judgment call as to the sales-stage they are at, and how things were when they stopped being your client.

Additionally, you can survey your clients. There are lots of free survey tools available to help with this but keep it simple, and no leading questions (those that steer the answer by mentioning in the question).

It won’t help you!

Open questions (those that result in an answer that is deeper than “Yes” or “No”) are the best tools for the job here.

4. Market research for new product development

There is indeed a challenge when it comes to conducting market research for a new product. There might be some overlap with your existing customer or prospective client database, in which case that could be used. But what if it’s for a new audience?

With something new, market research is even more important as it is not just the marketing and sales costs that are at stake here but the investment made into the research & development, production and operation.

There may be a case for some paid for market research, such as purchasing a database to conduct research with, which you can then use later on in your promotion too. How to do market research for a small business wouldn’t ordinarily start with paid research methods, but it might be necessary and worthy of the investment in certain circumstances.

Partnerships with trade bodies or trade press can also give you access to your target audience, and this is yet another route to go down.

The same tactics as mentioned above around interviews and surveys would likely be the best approach but obviously, this audience don’t know you and an incentive to take part may well be needed.

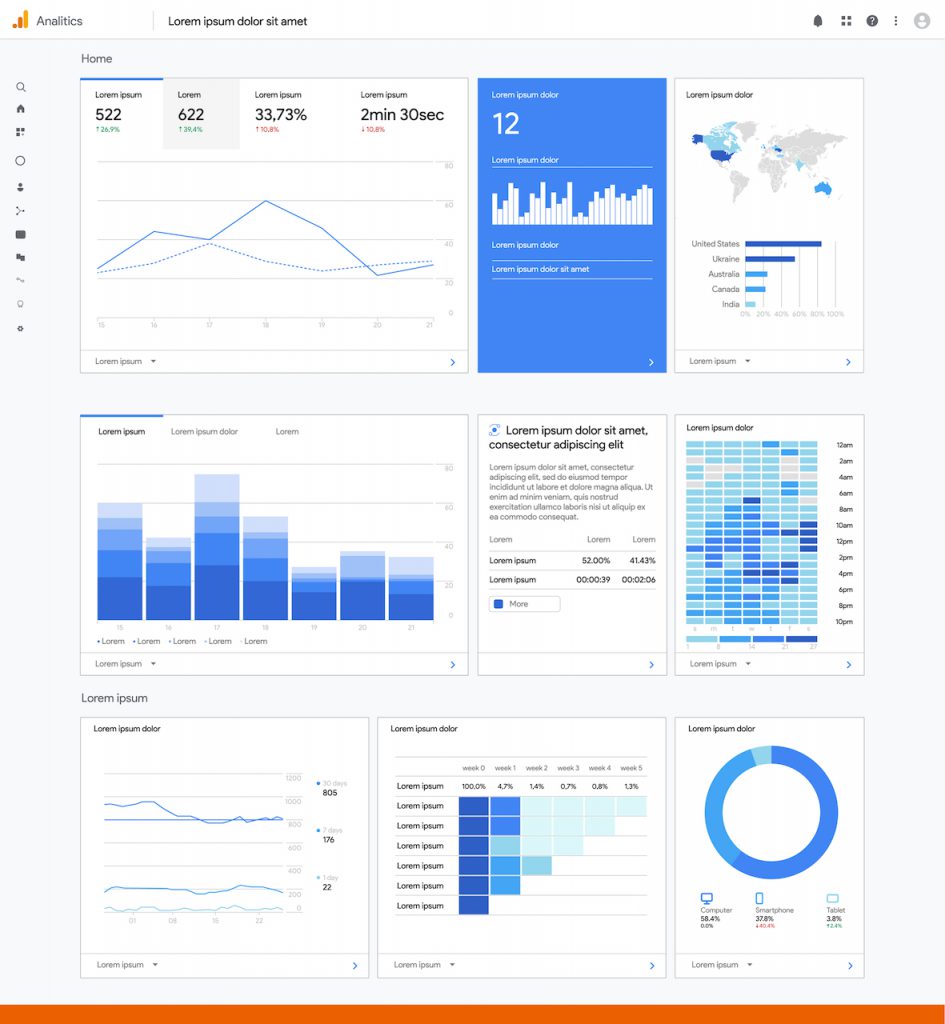

5. Finally, your Google Analytics data

There is a huge amount of data within your Google Analytics account. The two main areas we’d direct you to look at are:

- Behaviour – this tells you about the content being engaged with from which you can deduce what your audience is interested in, what they like and don’t like (based on entry and exit rates to certain pages).

- Audience – here you can find out demographic information about those visiting your site as well as their interests (which Google has pre-categorised for you). It’s really interesting to compare who is coming to your site versus your actual clients. Are they similar? If not, you could be losing out on a whole potential audience through your website not targeting/converting them or your website might be targeting the wrong type of people!

Therefore, be sure to have it set up correctly in order to capture this data.

Having a plan for your market research and acting on the insights

There are a number of different tools, routes and tactics a small business can use for conducting market research. Having the time to plan it, conduct it and digest it is often a challenge for SMEs.

Frequently, an outside perspective can be incredibly beneficial for spotting the trends and opportunities. Additionally, they won’t be limited by preconceptions or previous efforts, and this means they will more often bring an exciting fresh approach to your marketing and sales strategy.

Market research is only useful if you are going to take action because of it. When business owners or their teams are already short on time, this is where a small business marketing agency can really provide benefit.

They can:

- Identify and define the target audience – their location, needs, objections and how you differ from your competitors

- Identify where your target audience is – determine which outlets will be the most successful for reaching your audience and which social media channels suit your brand best

- Conduct marketing to reach your audience – from tailored emails, social media and blog-driven campaigns, SEO-rich content optimised to match your different audiences’ search criteria through to print and design work and more.

Targeting your audience is one of the most effective ways to deliver the best returns for your business, and that definition of why, where, why and what, is how good market research supports the bigger picture efforts.